Yes, applying for multiple car loans can lower your credit score due to hard inquiries, especially if done outside a short rate-shopping window. However, when timed right, these inquiries are grouped and have limited impact.

Most people don’t realize one car purchase can lead to five, even ten, credit inquiries in a single day, and every one of them can show up on your credit report.

That’s the cost of getting “shotgunned” by dealers. While credit models often group these inquiries for scoring, lenders still see them individually. It can affect future loan approvals, raise apartment deposits, or even get you denied for a basic credit card.

Here’s what you need to know right now:

- Apply to no more than 2–3 lenders on the same day

- Stay within the 14–45 day rate-shopping window

- Don’t mix mortgage and auto loan applications

- Prequalify first to avoid hard pulls

- Request the list of lenders before permitting a dealership

- Act fast if you see unauthorized inquiries, especially with Experian

- Disputes can work, but fast removal often requires professional support

Credit damage from car loan shopping is avoidable and reversible. If you’ve ever felt blindsided by a car loan credit hit, what you’ll learn next could save your score (and sanity).

What Really Happens When You Apply for a Car Loan Multiple Times

Applying for a car loan seems simple, until your credit report shows multiple hard inquiries from one dealership visit.

Let’s break down why that happens, how it affects your score, and what credit models actually do when you apply more than once.

Car Loan Applications Trigger Hard Inquiries

When you apply for a car loan, the lender runs a hard inquiry to check your credit history. Each hard pull can reduce your score by about 3 to 5 points temporarily.

The Difference Between Soft and Hard Pulls

Soft inquiries, like checking your own credit or getting prequalified, don’t affect your score. Hard inquiries do. They appear on your report for up to two years.

How Credit Models Group Multiple Applications

FICO and VantageScore group auto loan inquiries made within a short time window. FICO’s newer models give you 45 days, VantageScore typically uses 14.

If your applications fall within that window, they count as one inquiry for scoring. This lets you compare lenders without damaging your score, if timed right.

Why Inquiries Can Still Linger

Even when inquiries are grouped for scoring, each one remains visible on your credit report.

Some consumers notice that months, even years, after applying for a car loan, multiple inquiries still appear.

While their impact on your score fades over time, a high number of visible inquiries can still make future lenders cautious.

What Dealer Shotgunning Really Means

Dealerships often submit your application to multiple lenders at once, called shotgunning. This can trigger 5 to 9 hard pulls in one day.

Even when grouped by score models, those pulls still show up one by one on your report.

And even if your score survives the impact, too many visible inquiries can cost you later. Next, let’s talk about how to avoid that risk when shopping for a car loan.

Helpful Resource → Hard Inquiry Meaning and Impact on Credit Reports

How to Shop for a Car Loan Without Damaging Your Credit

Shopping for the best auto loan rate is smart, but doing it the wrong way can leave your credit score looking worse than before.

Here’s how to approach the process with strategy and control.

Apply to a Few Lenders on the Same Day

To protect your score, limit full loan applications to 2 or 3 lenders in one day. This keeps inquiries tightly grouped and avoids unnecessary red flags.

Applying on the same day also ensures those 2–3 pulls fall within the same scoring model window and reduce credit score exposure.

Use the Rate-Shopping Window to Your Advantage

Credit scoring models give you a buffer.

FICO’s latest models allow 45 days, while VantageScore uses a 14-day window. Within these windows, multiple auto loan inquiries count as just one for your score.

To play it safe, aim for the shorter 14-day span if you’re unsure which model your lender uses.

Stick to One Loan Type at a Time

Only same-type inquiries are grouped.

That means mortgage and auto loan inquiries won’t combine. If you’re applying for both, stagger them outside the rate-shopping window to avoid double hits.

Applying for different loan types at once can trigger multiple scoring events that impact your profile negatively.

Prequalify Before You Apply

Start with prequalification, especially with a local bank or credit union.

These soft inquiries won’t hurt your score and can help you narrow down the best offers before pulling the trigger on a full application.

This step gives you better control and protects your report during early-stage rate comparisons.

Protect Yourself From Dealer Shotgunning

Worried about a dealership submitting your info to ten lenders? You’re not alone.

Always ask which lenders they’ll use and request that list in writing before signing anything. Clear communication upfront can prevent a flood of unnecessary inquiries.

With a few smart steps, you can find a competitive car loan without taking unnecessary credit damage. Next, let’s look at what to do if your score’s already taken a hit.

Helpful Resource → Hard Inquiry Removal Service Explained Clearly

How to Remove Car Loan Inquiries From Your Credit Report

If your credit report is already showing multiple hard inquiries, especially from a single car purchase, you’re not out of options.

Here are the most effective ways to clean things up.

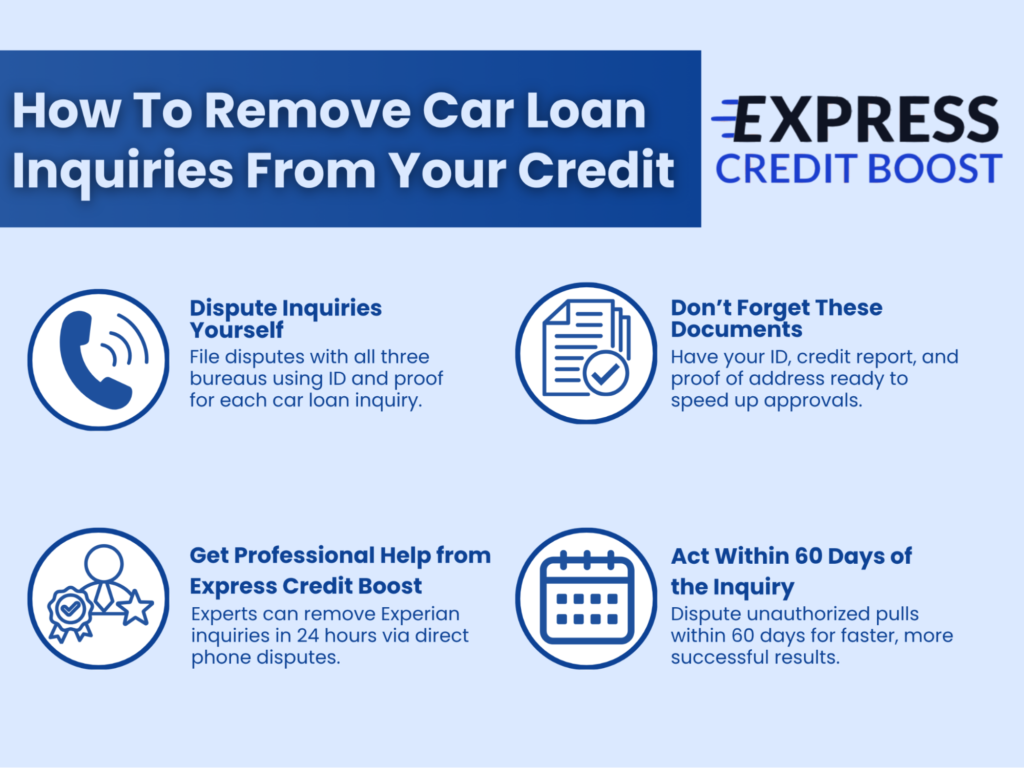

Dispute Inquiries Yourself

You can file disputes directly with each credit bureau, Experian, Equifax, and TransUnion.

This involves writing formal letters, including your ID and proof of address, and explaining why the inquiries are unauthorized or incorrect.

The process usually takes up to 30 days and requires follow-up.

Use a Professional to Remove Inquiries From Experian Fast

For Experian, a professional can often get results much faster.

If the inquiries meet certain criteria, they can be removed within 24 hours through a phone-based dispute process.

This isn’t possible with Equifax or TransUnion, which still require written filings.

What Documents You’ll Need

Whether you go the DIY route or get expert help, you’ll need to provide:

- A clear photo of your driver’s license

- A recent credit score report

- A utility bill or other proof of address

Having these ready speeds up the process and ensures your disputes are accepted.

Tip: Act Within 60 Days of the Inquiry

If you believe a lender pulled your credit without clear consent, you can challenge it within 60 days of the inquiry date.

This window is key for faster removals and better outcomes.

Hard inquiries don’t have to follow you for years. With the right approach, you can clean them up fast and move forward.

Why You Shouldn’t Ignore Your Credit Score, Even If You Don’t Need a Loan Today

It’s easy to assume your credit score only matters when you’re applying for a loan, but that’s not the full picture.

Your credit health affects far more than just borrowing.

Poor Credit Can Limit Your Options

A low score doesn’t just mean high interest rates.

It can lead to denied credit card applications, higher deposits for apartments, and even missed job opportunities, especially for roles that require background checks or financial responsibility.

Inquiries Can Stick Around Longer Than You Think

One common frustration is seeing inquiries linger long after the loan is approved and paid off.

Many are surprised that hard pulls remain on their report up to 24 months, even if the actual credit impact fades earlier.

While the score drop may be temporary, the record stays, and that alone can lead to hesitation from lenders or landlords.

Credit Health Affects More Than Just Loan Approvals

Your credit score plays a role in everyday financial decisions.

Even if you’re not applying for a loan today, it can influence whether you qualify for a new apartment, avoid paying a security deposit, or get approved for a phone plan.

Some employers also factor in credit when hiring for financial or security-sensitive roles.

Maintaining a healthy score now protects your options later and prevents unexpected roadblocks when life changes fast.

Take back control. Let’s fix what’s holding your score down.

Think Twice Before Letting a Dealer Pull Your Credit 12 Times

Multiple car loan applications don’t have to ruin your credit, if you handle them right.

Time your applications carefully, understand how scoring windows work, and avoid letting dealerships shotgun your info without consent.

If your score takes a hit, know that there are ways to fix it fast.

Hard inquiries may stay on your report for up to two years, but their impact doesn’t have to.

With the right strategy and support, you can take back control of your credit and protect your future financing options.

Don’t let a 5-minute car loan app block your next big move. Clean it up today with Express Credit Boost, fast, transparent, and client-first credit help that gets results.