A hard inquiry is when a lender reviews your credit report after you apply for new credit. It can temporarily lower your score and signal risk to other lenders.

Why Hard Inquiries Matter More Than You Think for Your Credit

Hard inquiries are part of nearly every financial milestone, from credit cards to car loans. While they may seem minor, they can carry real consequences:

- Appear on your credit report for two years

- Count against your score for one year

- Drop scores by 5–20+ points depending on your profile

- Make you look “desperate” if clustered together

- Treated differently by FICO across versions (FICO 8 vs mortgage models)

- Cannot be removed if legitimate, only disputed if fraudulent

Knowing how inquiries work helps you protect your credit. And by understanding removal options, you can take control before they block important approvals.

That’s why the details that follow matter, and why it’s worth reading to the very end.

The Basics You Need Before Understanding Hard Inquiries

Before exploring how hard inquiries affect your credit, it helps to understand the bigger picture.

Credit scores, different score types, and the role of the bureaus all set the stage for how inquiries are measured and why they matter.

Credit Scores: FICO vs VantageScore

Credit scores are the backbone of lending.

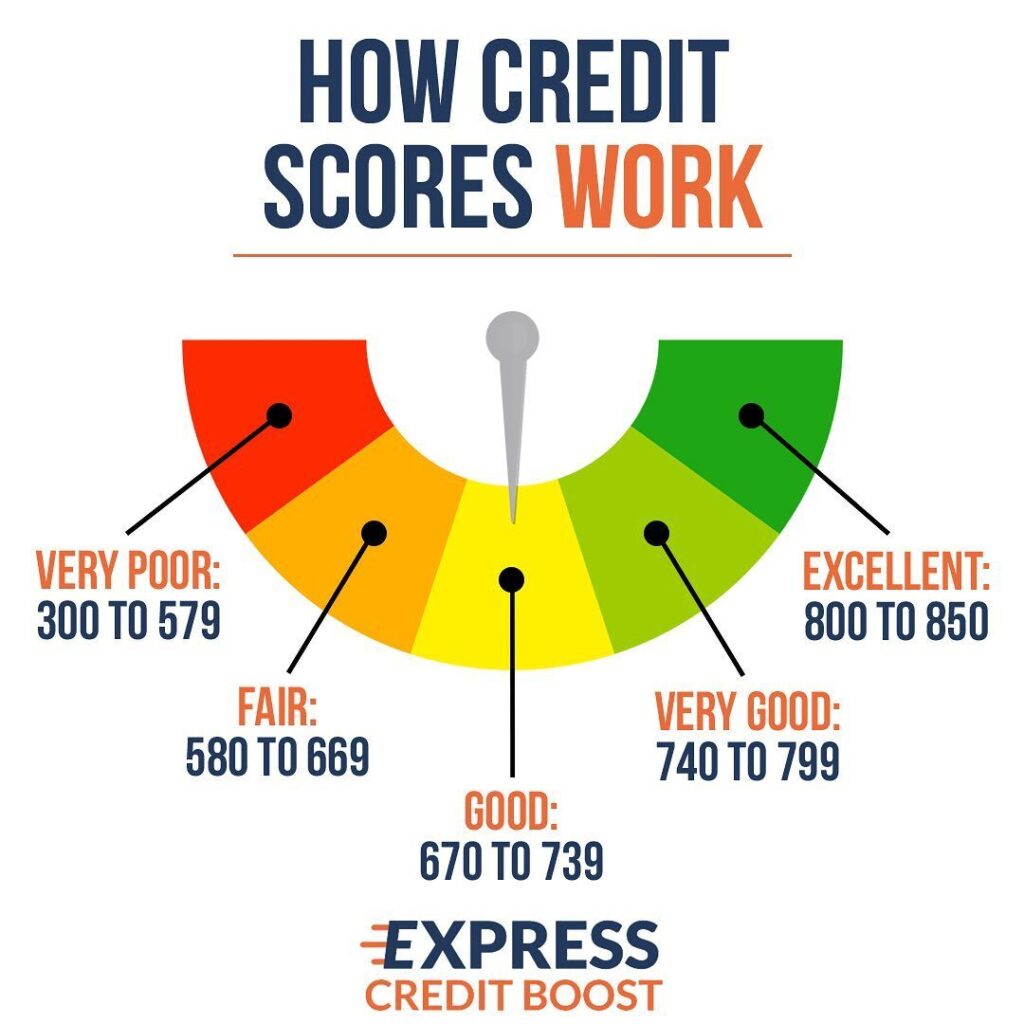

Both FICO and VantageScore use a 300 to 850 range, built on factors like payment history, credit utilization, age of accounts, and recent activity.

Lenders overwhelmingly rely on FICO, but consumers often see VantageScore through free apps. Even small changes in these categories can shift your score and influence loan approvals.

Educational vs Commercial Scores

Not all scores are created equal.

The number you see on an app is usually an educational score, designed for consumers and inexpensive to generate.

Lenders use commercial scores, which cost more but provide the precision they need to make funding decisions.

This gap explains why your score at a bank can look different from what you checked online the night before.

The Credit Bureaus

Experian, Equifax, and TransUnion gather and report credit data, but not every lender reports to all three.

That means your score can vary depending on which bureau a lender pulls from. For bigger loans like mortgages, lenders often check all three reports to reduce risk.

In everyday lending, though, it is more common for banks and credit card companies to pull just one bureau, not all three.

Auto lenders and landlords may also favor a single report when making quick approval decisions.

Among the three, Experian stands out because it is used most frequently for business loans and SBA-backed lending.

This makes Experian inquiries especially important for entrepreneurs or small business owners, since even a few extra inquiries on that bureau can mean the difference between approval and denial.

Understanding Hard Inquiries

Hard inquiries are more than just a line on your credit report, they are a signal lenders use to judge how much risk you might bring.

To see the full picture, it helps to look at how they work, when they happen, and how they affect different types of credit files.

Hard vs Soft Inquiries

Every credit check falls into one of two categories.

Soft inquiries, like checking your own score or a pre-approval offer, have no impact and are invisible to lenders.

Hard inquiries, triggered by credit applications, are visible to all lenders and can lower your score temporarily.

These basics provide the framework for understanding why hard inquiries exist and why lenders use them, which is where we’ll go next.

Hard Inquiry Process

When you apply for new credit, the lender requests your report from one or more bureaus.

This check becomes a hard inquiry, visible to all other lenders. It can reduce your score temporarily and stays on your record even if the application is denied.

Common Situations

Hard pulls show up most often with credit card applications, car loans, mortgages, personal loans, SBA loans, and even rental housing.

A single car dealer can shotgun your application to more than a dozen lenders in a day, creating a cluster of inquiries that looks risky to future creditors.

Why Lenders Use Hard Pulls

Lenders choose hard pulls instead of soft checks because they get more detail.

Along with the score and report, they receive reason codes explaining the score, which helps in underwriting.

Hard pulls also act as a signal to other lenders that you are seeking new credit, which makes the system more transparent.

FICO Rules on Multiple Inquiries

FICO groups certain inquiries together when you are rate shopping.

Mortgage, auto, and student loan inquiries made within 14 to 45 days count as a single inquiry, so comparing rates does not unfairly damage your score.

Score Impact

The effect of a hard pull varies. On a thick, established file the drop may be only a few points.

On thin or new files it can be 20 points or more. FICO 8 tends to be more forgiving, while older mortgage models (FICO 2, 4, and 5) weigh inquiries more heavily.

Duration of Hard Inquiries

Hard inquiries remain on your report for two years but only affect your score for the first year.

They cannot be removed if they are legitimate and tied to an account, only errors or fraudulent ones can be disputed.

Hard inquiries may seem small, but their timing and frequency can be the deciding factor between approval and denial.

This is why understanding who they affect most is the next important step.

Who Gets Hurt the Most by Hard Inquiries and Why Removal Matters

Hard inquiries do not impact everyone equally. For some, they create only a small dip, but for others, they can become a roadblock to financial progress.

Understanding who is hit hardest helps explain why inquiry removal can be so valuable.

Thin and New Credit Files

If you have little credit history, a single inquiry can lower your score by 20 points or more.

With fewer accounts and less payment history, inquiries carry more weight and make your profile look riskier.

Everyday Workers

Many of those most affected are blue-collar and lower white-collar workers in the 25 to 45 age range.

They often need approvals for apartments, cars, or small business loans. In these cases, even a handful of inquiries can cause higher rates or outright denials.

Car Dealership Applications

One of the most damaging situations is at auto dealerships.

Dealers often shotgun applications across 10 to 20 lenders at once.

This flood of inquiries appears as if the customer is desperate for credit, even though it was the dealer’s process, not the borrower’s choice.

SBA Loan Applicants

Experian plays a major role in small business lending.

For entrepreneurs seeking SBA loans, too many Experian inquiries can block funding opportunities, even when the business itself is sound.

How Lenders Perceive Multiple Inquiries

Clusters of inquiries can create the impression of financial stress.

Lenders may assume you are struggling, even when the activity was outside of your control. This perception alone can sink applications.

Why Removal Makes a Difference

Inquiry removal can be transformative. One client had 80 inquiries successfully deleted, making it possible to access new funding again.

For those attempting DIY disputes, the process is often overwhelming, 10 to 20 pages of filings per bureau, weeks of waiting, and $30 to $40 in postage per round.

This is why removing inquiries is not just about cleaning a report, it is about restoring opportunities. With that in mind, let’s look at proven methods people use to remove hard inquiries.

Proven Methods to Remove Hard Inquiries

Hard inquiries can hold you back, but they do not have to be permanent roadblocks.

While legitimate inquiries cannot be erased without cause, there are proven ways to remove errors, fraudulent pulls, or excessive clusters that unfairly weigh down your credit.

Disputing Unauthorized Inquiries

The first step is identifying inquiries you did not authorize. Fraud, clerical errors, or mistaken identity can all cause inquiries to appear on your report.

In these cases, you can file disputes directly with the credit bureaus.

If you suspect fraud, freezing your credit prevents new inquiries and can help stop further damage while you resolve the issue.

Experian Same-Day Removal

Experian is unique among the three bureaus because certain inquiries can be removed over the phone within 24 hours.

This process requires uploading documentation, such as a driver’s license, proof of address, and a recent credit report.

For business owners seeking SBA loans, where Experian is the primary bureau reviewed, same-day removal can be the difference between getting funded and being denied.

Equifax and TransUnion Disputes

Unlike Experian, Equifax and TransUnion usually take around 30 days to process disputes.

Success often depends on providing strong documentation, including proof of identity and a clear explanation of why the inquiry is incorrect or unauthorized.

Patience is required, but these disputes can still restore valuable points to your credit score.

Professional Credit Repair Services

For those with multiple inquiries, professional help can speed the process.

Services like Express Credit Boost have the capacity to handle bulk disputes, using proven methods to contest 15 to 80 inquiries in a single case.

Unlike competitors that charge subscription fees regardless of results, a pay-for-performance approach means you only pay after successful deletions.

This model has helped thousands of clients regain lost opportunities quickly and with confidence.

Long-Term Credit Strategy

Removing inquiries solves today’s problem, but preventing future issues is just as important.

Apply only when necessary, avoid stacking credit card applications, and be mindful of how auto dealers handle financing.

Use rate shopping rules wisely by keeping applications within the FICO window. Combine these steps with strong habits like on-time payments and low utilization to build resilience in your credit profile.

By knowing your options, you can turn the challenge of hard inquiries into an opportunity to protect and rebuild your financial standing.

Key Takeaways: Regaining Control of Your Credit Profile

Hard inquiries may look small on paper, but they carry strategic weight in the eyes of lenders. A handful might barely register, while clusters can shut the door on approvals altogether.

Experian removals can sometimes be resolved in just 24 hours, while Equifax and TransUnion typically take longer, making timing and strategy crucial.

Those with new credit files, SBA loan applicants, and auto buyers are often the most vulnerable, since inquiries hit their scores harder and can create the impression of financial desperation.

While disputes can be handled alone, the process is lengthy and costly, especially when dozens of inquiries are involved.

Professional services can save time, reduce stress, and achieve results that DIY methods rarely match.

If hard inquiries are standing in your way, Express Credit Boost is ready to help you clear them and move forward with confidence. Contact us to start your path to better credit today.