When unnecessary hard inquiries are removed, your credit score can recover within days, and your overall credit profile appears stronger to lenders. Fewer inquiries mean higher approval odds, better loan terms, and improved financial credibility.

How Removing Hard Inquiries Early Can Quickly Strengthen Your Credit Profile

Hard inquiries fade naturally after 24 months, but if removed earlier, especially unverified ones, you can experience faster results.

Removing excess or unauthorized inquiries helps by:

- Restoring your FICO score by up to 30–80 points

- Reducing “credit-seeking” risk perception

- Improving eligibility for SBA loans, apartments, and auto financing

- Rebuilding confidence in your financial profile

Even small improvements can change how lenders view your stability and readiness for new credit.

So if your report feels crowded with inquiries, the right removal strategy can create room for real financial progress.

Keep reading to learn exactly how to make that happen, legally, effectively, and fast.

The Real Power Behind Hard Inquiry Removal: What Actually Changes When They’re Gone

For most people, a hard inquiry seems like a harmless line on a credit report.

But when several accumulate, they can quietly lower approval odds and make lenders second-guess your financial stability.

Removing unnecessary inquiries can do far more than improve your score, it can reshape how lenders and algorithms view you.

Immediate Score Recovery

When legitimate inquiries are successfully deleted, credit scores often rebound quickly.

A single inquiry may only drop a score by a few points, but multiple removals can have a real impact.

Many individuals see their FICO scores rise within weeks, and some have experienced 30 to 80 point jumps within 24 hours of Experian updates.

Why It’s About More Than Numbers

Hard inquiry removal isn’t just about chasing a higher score.

It’s about restoring how lenders perceive you.

Too many inquiries can create the illusion of financial desperation, even when your record shows responsible credit behavior.

Fewer inquiries project confidence and control, two qualities lenders reward.

Better Chances for Approvals

Banks, landlords, and lenders often evaluate inquiry history alongside credit scores.

Reducing the number of hard pulls can improve your odds for SBA loans, apartment approvals, or car financing, especially when other parts of your credit file are in good shape.

The Emotional Reset

For many people, seeing unnecessary inquiries erased brings a sense of relief.

It’s not just a technical win, it’s a psychological one. Knowing your report reflects your true behavior restores confidence and renews motivation to keep improving your credit profile.

Helpful Resource → How To Remove Hard Inquiries From Your Credit Report | Guide

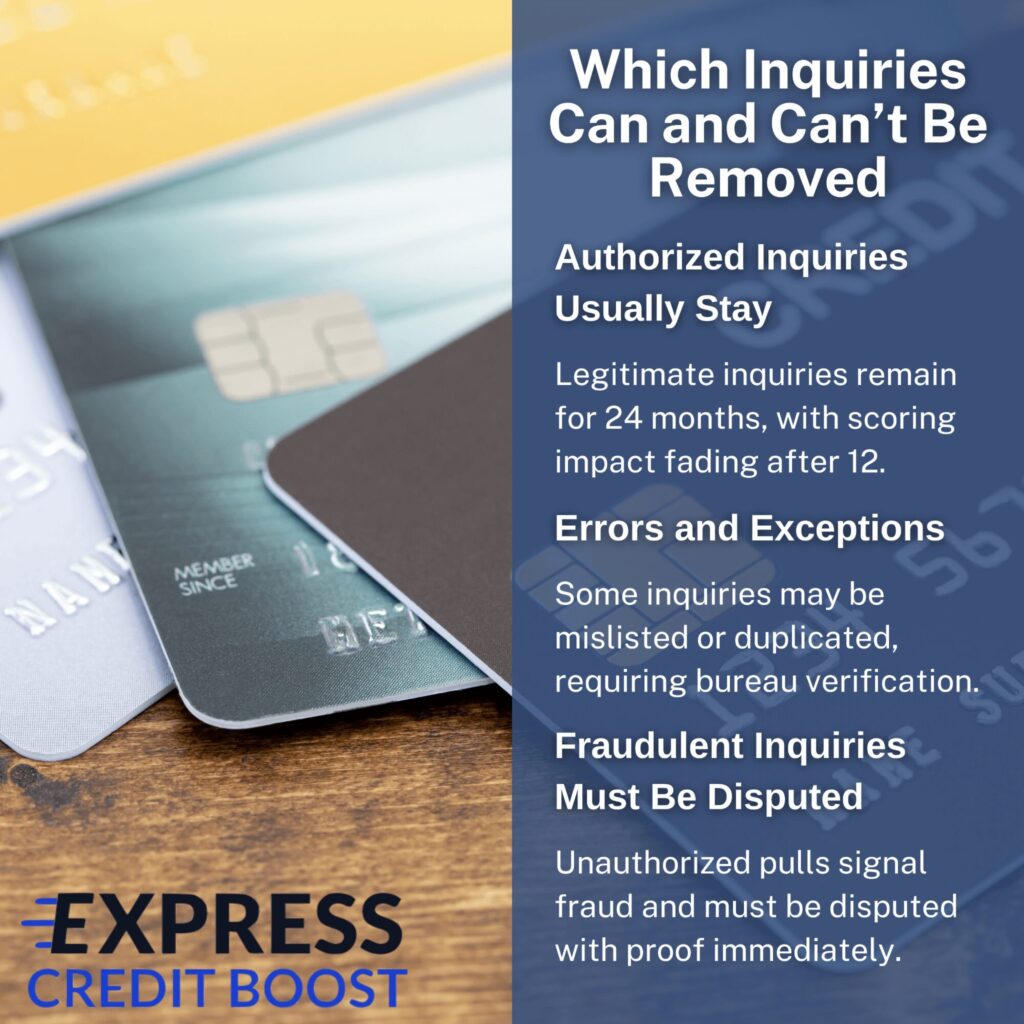

Hard Inquiries: What Can Be Removed and What Can’t

Most credit reports contain a mix of legitimate and unnecessary hard inquiries, but not all of them are eligible for removal.

Understanding which ones can legally come off, and which must stay, helps you make smarter, more realistic credit decisions without wasting time or effort.

What Can Be Removed

Some hard inquiries are fair to dispute and can be legally removed if they fall under specific categories.

These usually involve mistakes, unauthorized pulls, or excessive lender activity that doesn’t reflect your actual intent.

Removable inquiries include:

- Unauthorized or fraudulent inquiries – When your personal data was used without consent or through identity theft.

- Mistaken lender submissions – When a creditor accidentally runs your credit more than once for the same application.

- “Shotgun” dealership applications – Auto or mortgage dealers sometimes send your information to 10–80 lenders at once. Many of those inquiries can be disputed if you didn’t approve each one individually.

- Outdated inquiries – If a pull is tied to a closed or inactive account, it may qualify for deletion.

- Clerical or duplicate errors – Instances where the same lender pull appears multiple times on the same report.

These inquiries can often be removed through a direct dispute with the credit bureaus once evidence of error or lack of authorization is provided.

What Can’t Be Removed

Some hard inquiries are completely legitimate and form part of your verified credit history.

These entries show lenders how you’ve pursued credit over time, and because they were authorized by you, they cannot be lawfully deleted or disputed.

Non-removable inquiries include:

- Approved credit applications – When you applied for a credit card, auto loan, mortgage, or personal loan, those inquiries were fully authorized.

- Credit limit increase requests – Asking your lender to raise your limit also results in a valid hard pull that must remain.

- Inquiries linked to active accounts – Any inquiry tied to an open or ongoing account is automatically verified and cannot be challenged.

- Authorized joint applications – Shared loan or co-signed credit applications are recorded for both applicants and remain as legal entries.

- Confirmed lender verifications – When a creditor responds to a bureau confirming that you did apply, the inquiry becomes locked in your record.

These types of inquiries serve as legitimate proof of your borrowing activity and cannot be erased simply because they lower your score or look excessive.

If you try to dispute them, the bureaus will contact the original creditor, who will verify the authorization and close the claim.

When They Disappear Naturally

All hard inquiries fall off automatically after 24 months.

Their impact on your score fades within about 12 months, but they continue to appear visually on your report until the two-year mark.

This natural aging process ensures the inquiry no longer affects your creditworthiness, even though it remains listed for recordkeeping.

Why It Still Matters

Even inquiries that no longer affect your FICO score can still influence how lenders perceive you.

Some SBA and business lenders closely evaluate inquiry history as part of their risk analysis.

A high number of recent inquiries can signal instability, while a cleaner record communicates control and responsibility.

Removing what you can, and allowing the rest to age off naturally, creates a balance between accuracy and progress.

It’s not just about raising your score; it’s about shaping how lenders interpret your financial behavior and readiness for future credit.

Helpful Resource → When Do Hard Inquiries Fall Off? Guide and Timeline

The Smartest Ways to Remove Hard Inquiries and Clean Up Your Credit Fast

Hard inquiries might seem minor, but too many of them send a message to lenders that you’re desperate for credit, even when you’re not.

Each mark slightly lowers your score, but more importantly, it can make banks and loan officers hesitate.

The sooner you remove unnecessary inquiries, the faster your credit profile recovers.

Dispute Unauthorized or Mistaken Inquiries

If you spot an inquiry you didn’t approve, you can dispute it directly with the credit bureaus.

This DIY route works but usually involves 10–20 pages of correspondence and can take 30–45 days per bureau to resolve.

Wait for Them to Age Off

Legitimate inquiries can’t be deleted, but they fade naturally.

They stop affecting your FICO score after about 12 months and disappear completely after 24. Waiting works, but it won’t help if you need financing soon.

Get Professional Help

Professional services can remove unverified Experian inquiries within 24 hours through direct bureau verification.

This approach ensures accuracy, saves time, and delivers results quickly.

Express Credit Boost specializes in this process, operating under a pay-after-removal model with a proven 200+ monthly client capacity.

For anyone seeking faster approvals or better loan terms, professional help remains the most efficient way to clear your report and move forward with confidence.

Reclaiming Control Over Your Credit

Removing hard inquiries is about more than gaining points—it’s about restoring financial confidence. Each verified deletion clears unnecessary noise from your record, helping lenders see your true reliability.

With the right approach, you can reshape how your creditworthiness is viewed and position yourself for better financial opportunities.

Ready to clean your credit the right way?

Start today with Express Credit Boost, the trusted service for verified 24-hour Experian inquiry removal and faster loan approvals.