Having too many credit inquiries can lower your score and make lenders see you as a risk, even when you’re financially stable. While inquiries are small individually, multiple recent ones can signal desperation to creditors. The good news is that most are manageable or removable with the right approach.

Here’s what matters most:

- Dispute unauthorized inquiries with Experian, Equifax, and TransUnion.

- Differentiate fraud from clerical mistakes before filing.

- Wait out valid inquiries, they lose impact after 12 months.

- Avoid clustered applications to prevent red flags.

- Use prequalification tools and secured cards for rebuilding.

- Stay consistent with payments and utilization to offset dips.

Whether your inquiries came from car financing, apartment checks, or business loans, every one tells a story, and lenders read between the lines.

If you want lasting credit stability, it’s worth understanding how each inquiry shapes your financial reputation and how to take control of it.

Why “Too Many Inquiries” Show Up, and Why They Hurt More Than You Think

Seeing multiple inquiries on your credit report can feel unfair, especially when most come from legitimate applications. But in the eyes of lenders, patterns matter as much as your score.

Let’s explore where these inquiries come from and why they can create problems even for financially responsible borrowers.

Auto Financing Triggers Multiple Credit Pulls

Auto dealerships often send your loan application to several lenders to secure the best rate.

Each lender’s credit check appears as a separate hard inquiry.

Even though this process is common, it can flood your report with multiple entries in a single day, giving the false impression that you’ve applied for numerous loans.

Rental and Apartment Screening Inquiries

When landlords run tenant checks, they may use several screening agencies at once.

While this seems harmless, it can lead to multiple inquiries within days.

For renters trying to move quickly, it can look like a surge of new credit applications, slightly lowering their score during an already stressful process.

Business and SBA Loan Overlaps

Applying for business or SBA loans often leads to personal credit checks in addition to business ones.

A single application can trigger several hard pulls across Experian, TransUnion, and Equifax, especially when lenders evaluate both credit histories for approval.

Data Errors and Duplicates from Credit Bureaus

Credit bureaus handle massive amounts of data, and occasional duplication is inevitable.

A single application might appear twice or under a different lender name, inflating your inquiry count and lowering your score until corrected.

Inquiry Clusters from Financial Shopping

When you apply for different credit products within a short window, a car loan, credit card, or personal loan, the system flags it as aggressive borrowing.

Even responsible borrowers can appear risky when inquiries are tightly clustered.

The Perception of Urgency and the 12-Month Sensitivity Period

Lenders don’t see the context behind your applications.

To them, several recent inquiries signal financial urgency or uncertainty. Inquiries matter most during the first 12 months, though they remain visible for two years.

Even borrowers with 770 scores may face denials if too many applications fall within that window.

Everyday actions like buying a car, renting an apartment, or applying for a loan can create multiple inquiries, but lenders may still see them as red flags.

Knowing why they appear and how they’re interpreted is the first step toward controlling their impact.

Helpful Resource → Hard Inquiry Meaning and Impact on Credit Reports

Smart, Proven Fixes to Remove or Neutralize Excessive Inquiries

Now that you know why inquiries appear, the next step is learning how to deal with them.

Some can be challenged and removed, while others simply need time to fade. The key is knowing when to act and when patience works best.

Disputing Unauthorized Inquiries

Check your credit reports from Experian, TransUnion, and Equifax.

If you find inquiries you never approved, file a dispute with the reporting bureau. Include identification and proof that you didn’t authorize the credit check.

Verified unauthorized inquiries must legally be deleted, often within 30 days.

Distinguishing Identity Theft from Simple Errors

An unfamiliar lender name doesn’t always mean fraud.

Many appear under their financing partner’s name.

Confirm the source before disputing. If it’s identity theft, file an FTC report and place a fraud alert. If it’s a reporting error, contact the lender directly for faster correction.

Waiting for Inquiries to Age Out

Legitimate inquiries lose impact after 12 months and disappear entirely after 24.

If they’re valid, time is the cleanest fix. Avoid new credit applications while you wait, and your score will usually recover within a few months.

When Professional Help Saves Time

DIY credit repair can be slow, especially when disputes require follow-ups, mailed documentation, or inconsistent bureau responses.

Many people spend weeks waiting for updates or navigating unclear processes.

Professional services, on the other hand, often have direct dispute channels and faster resolution timelines, making them a practical choice when timing is critical.

Dispute what’s wrong, wait out what’s valid, and get professional help when timing matters.

Next, let’s look at which inquiries can’t or shouldn’t be removed, so your energy goes where it counts.

Helpful Resource → When Do Hard Inquiries Fall Off? Guide and Timeline

The Inquiries You Shouldn’t Remove

Not every inquiry on your credit report is a problem, or one you should try to erase.

Understanding which inquiries are legitimate helps protect your credibility and ensures your repair efforts stay within legal and ethical boundaries.

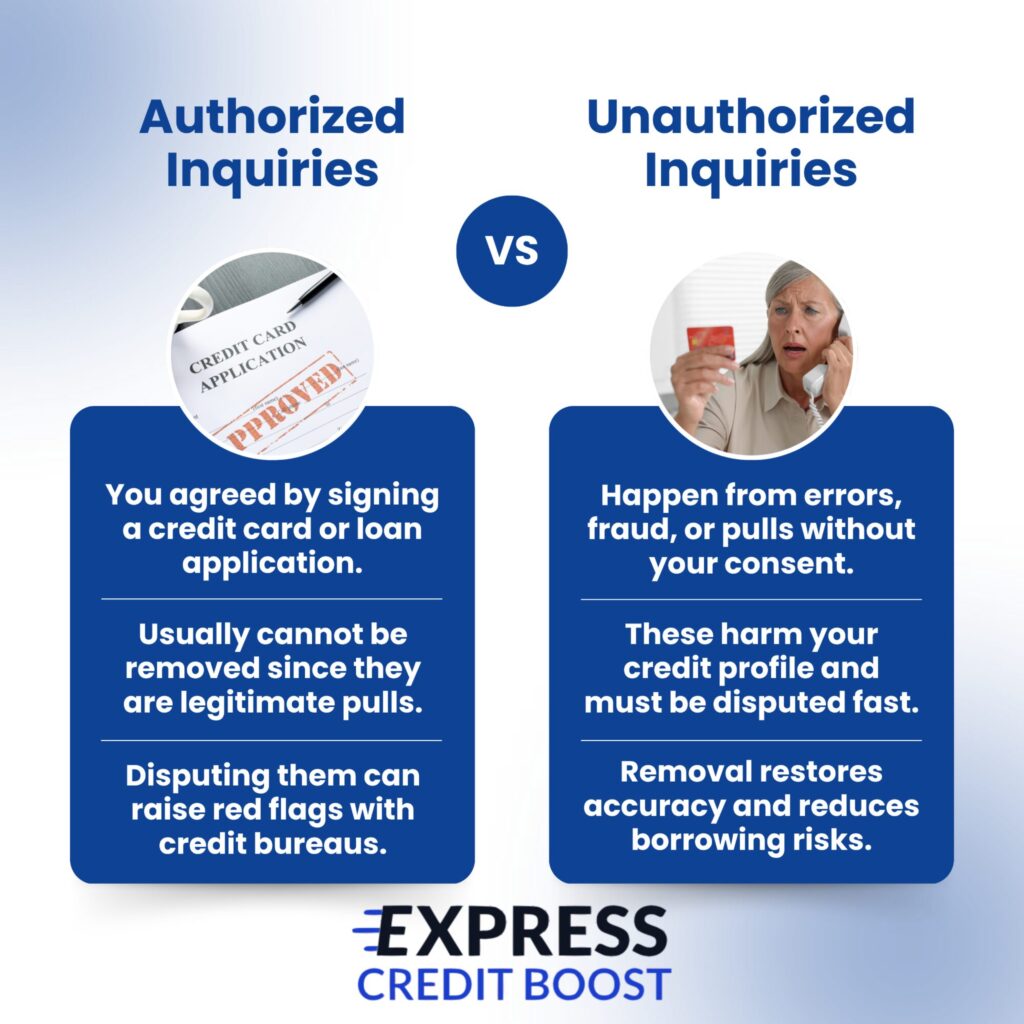

Legitimate Inquiries You Approved

Anytime you apply for a credit card, mortgage, auto loan, or personal loan, the resulting hard inquiry is considered valid.

These entries confirm that you voluntarily sought credit. Since they reflect accurate activity, credit bureaus will not remove them through disputes.

Why Disputing Valid Inquiries Can Backfire

Filing unnecessary disputes on legitimate inquiries can make you appear unreliable to both lenders and bureaus.

It may delay real dispute investigations and, in some cases, flag your account for frivolous filings.

The better approach is to let valid inquiries age naturally while focusing on removing inaccurate or unauthorized ones.

The Value of Ethical Credit Repair

Reputable credit repair companies emphasize compliance and transparency.

Ethical repair means contesting only what’s incorrect or unverifiable, not manipulating truthful data.

This honesty sets trustworthy providers apart in an industry often criticized for overpromising or bending rules.

When Waiting Is the Right Strategy

According to FICO’s one-year relevancy rule, inquiries affect your score most during the first 12 months, then lose nearly all impact before dropping off after 24.

Sometimes, patience and good credit habits are all you need to recover.

Not all inquiries are harmful, and trying to erase legitimate ones can do more damage than good. Knowing where to draw that line keeps your credit repair process both effective and credible.

How to Keep Your Credit Report Clean Moving Forward

Once you’ve managed existing inquiries, the next goal is prevention.

A clean credit report doesn’t happen by chance, it’s built through timing, awareness, and small habits that protect your score over time.

Here’s how to stay proactive and avoid the cycle of unnecessary inquiries.

Space Out Credit Applications

Each time you apply for new credit, lenders perform a hard inquiry. Apply strategically by leaving at least six months between applications.

This spacing allows your score to stabilize and prevents the appearance of aggressive borrowing.

Use Prequalification Tools

Many lenders now offer soft-pull prequalification, letting you check your eligibility without affecting your score.

Use these tools to explore options safely, especially for credit cards, personal loans, or refinancing.

Manage Utilization and Payment History

Keep credit utilization below 30% and make payments on time.

These two factors carry far more weight than inquiries and can help offset any temporary dips caused by recent applications.

Rebuild Smart with Secured Cards

If your credit needs strengthening, secured cards like Chime or OpenSky can help you rebuild responsibly.

They don’t always require a hard inquiry, making them a safe option for recovery without risking your score.

Monitor and Dispute Early

Check your credit reports regularly to catch unfamiliar inquiries or reporting errors. Disputing early prevents long-term score damage and protects you from potential fraud.

Many people feel trapped with high-interest or predatory lenders after too many inquiries, but strategic planning and patience change everything.

When you control the timing of your credit moves, your report, and your opportunities, stay clean and strong.

From Overwhelmed to In Control

Too many inquiries don’t have to define your creditworthiness.

With careful disputes, patience, and responsible credit use, you can rebuild trust with lenders and strengthen your overall financial profile.

Each strategic choice, spacing applications, monitoring reports, and maintaining low utilization, gradually restores your standing.

Need faster results?

Express Credit Boost can assist with 24-hour Experian hard inquiry removals, full credit repair, and credit balancing services to help you regain approval power quickly.

Contact us today to take control of your credit future with expert and compliant support.