Landlords often run either soft or hard credit checks during rental applications. Soft pulls don’t affect your score, but hard pulls can lower it slightly, depending on the system your landlord or property manager uses.

A hard inquiry digs deeper and may drop your score by 5–10 points for up to a year. Unfortunately, many renters never know which type will be used until after applying.

Here’s what you need to know before you submit your next rental application:

- When landlords actually perform credit checks

- Why some are soft and others hard

- How to prevent unnecessary hard pulls

- What to do if your score drops unexpectedly

Understanding this process early helps you rent confidently and protect your credit for bigger financial goals ahead.

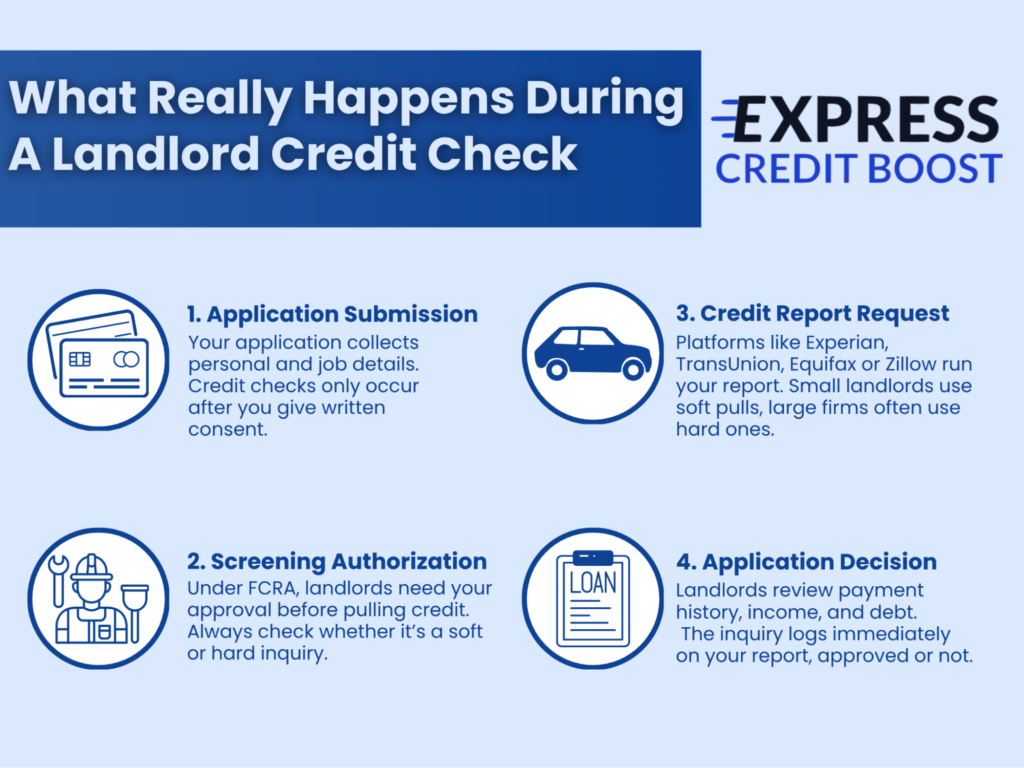

What Really Happens During a Landlord Credit Check: Step by Step

Before you ever receive a set of apartment keys, your landlord wants to confirm one crucial detail: that you’re financially reliable.

A credit check helps them assess this, giving insight into how consistently you pay bills and manage debt.

Understanding how and when this happens can protect your credit score and save you unnecessary stress.

Step 1: Rental Application Submission

The credit review process begins the moment you submit your rental application.

This form typically asks for your identifying details, employment information, and permission to run a background or credit check.

Many renters assume the credit pull happens immediately, but it only takes place once you authorize it in writing.

Step 2: Tenant Screening Authorization

Under the Fair Credit Reporting Act (FCRA), landlords must obtain your explicit consent before accessing your credit file.

This safeguard exists to protect your privacy and ensure you’re aware that an inquiry may occur.

Always read this section of your application carefully, it will specify whether the screening is performed directly by the landlord or through a third-party service.

Step 3: Credit Pull by Screening Service

Once authorized, the landlord or property management company uses a service such as TransUnion SmartMove, Experian Connect, RentCafe, Equifax, or Zillow to request your report.

This is the point where the inquiry type is determined.

A soft inquiry is more common with smaller landlords or screening platforms that only need a basic credit snapshot.

It checks for payment reliability without revealing detailed account information.

A hard inquiry, on the other hand, is typically used by larger property management firms.

They pull a full credit file to assess your long-term borrowing history and financial depth before approving a lease.

Step 4: Application Decision

After reviewing your report, the landlord makes a decision based on your payment record, debt-to-income ratio, and prior rental history.

Whether approved or denied, the inquiry has already been logged on your credit file.

In short, the inquiry occurs right after you authorize your application, not after you sign a lease.

Knowing when the credit check happens is important.

The next section explains why rental credit checks aren’t always consistent.

Some appear as soft inquiries, while others show up as hard pulls, and that small difference can quietly affect your credit score and future loan approvals.

Why Rental Credit Checks Aren’t Always Hard or Soft – and Why It’s So Confusing

Many renters are surprised to learn that not all landlord credit checks affect their score in the same way.

Some are soft inquiries that leave your credit untouched, while others are hard pulls that can cause a small drop.

The problem is that most applicants aren’t told which type will be used until after they apply.

What a Soft Credit Inquiry Means

A soft inquiry works like a background review.

It gives the landlord or property manager a quick look at your credit behavior without affecting your score.

Soft pulls are common with smaller landlords and platforms such as Zillow or the American Apartment Owners Association (AAOA).

These reports focus on payment consistency, current debts, and general reliability.

When a Hard Credit Inquiry Happens

A hard inquiry digs deeper into your financial history.

It provides a full view of your credit file, including open accounts, balances, and borrowing patterns.

Large apartment complexes and professional management firms often use this method for a more complete risk assessment.

A hard pull can lower your score by about five to ten points and stays on your credit report for up to two years, though the impact typically fades after one.

Why It’s So Inconsistent

Not all screening systems follow the same rules. Some automatically perform a hard inquiry even when a soft one would be enough.

Because of this, two renters applying for similar apartments could experience completely different credit outcomes.

Leasing agents may also be unaware of which type their system uses, leading to further confusion for applicants.

How Multiple Inquiries Can Add Up

Each hard inquiry signals that you’re seeking new credit.

If several landlords run checks in a short period, it can make you appear “credit-hungry” to future lenders. This can affect loan approvals and interest rates later on.

Understanding these differences helps you plan your rental applications more strategically. In the next section, we’ll cover clear steps to prevent unnecessary hard inquiries before you apply.

How to Prevent Unnecessary Hard Inquiries Before Renting

Protecting your credit during the rental process starts with awareness.

Many renters only learn about hard inquiries after the fact, when their score unexpectedly drops.

Fortunately, a few proactive steps can help you avoid unnecessary credit damage while still securing the home you want.

Ask Before You Apply

Always confirm which type of inquiry the landlord or property manager uses.

Simply asking, “Will this be a soft or hard credit check?” can make a big difference.

Responsible landlords are transparent about their process, and this one question helps you decide whether to move forward with the application.

Provide Your Own Credit Report

You can pull your own Experian or Equifax report and share it directly with the landlord.

Self-pulled reports count as soft inquiries and have no effect on your score. Many landlords are open to reviewing an updated personal report instead of running their own screening.

Apply Selectively and Time It Right

Avoid mass-applying to multiple apartments in a short time.

Each hard inquiry can lower your score slightly, and several in a row may suggest financial instability.

If you’re planning a major purchase, such as a car or home loan, wait until after that transaction before starting your rental search.

Know About Credit Freezes and Co-Signers

If your credit file is frozen, a landlord cannot complete a hard pull without your authorization.

Also, remember that co-signers may face their own hard inquiries, so it’s courteous to confirm the process before listing one.

Use Screening Bundles When Possible

Platforms like Zillow offer one-fee applications that allow you to apply to several properties with a single inquiry.

This approach keeps your credit activity limited and easier to track. Taking these small steps puts you back in control.

In the next section, we’ll look at what to do if a landlord has already performed a hard inquiry that shouldn’t be there.

When Landlords Hit Your Credit Too Hard: What to Do Next

Finding out that multiple landlords have run hard inquiries on your credit report can be frustrating.

Many renters only discover this after a loan denial or a sudden score drop. The good news is that these marks aren’t permanent, and there are clear steps you can take to address them.

Step 1: Check All Three Credit Reports

Start by pulling your reports from Experian, Equifax, and TransUnion. Each bureau may show different inquiries, and reviewing them helps you identify where the unnecessary pulls occurred.

Step 2: Confirm Authorization

Contact the landlord or property management company and ask for proof that you authorized the credit check.

Under the Fair Credit Reporting Act (FCRA), landlords must have your written consent before performing an inquiry.

Step 3: Dispute Unauthorized or Duplicate Inquiries

If you find any inquiries you didn’t approve, file a dispute directly with the credit bureau. Provide documentation showing the inquiry was made without consent or that it was duplicated in error.

Step 4: Request Consolidation

If multiple inquiries came from the same rental application, you can cite FCRA provisions requesting that they be consolidated into one.

Professional help is also available. Express Credit Boost specializes in fast inquiry removals, offering 24-hour Experian cleanup and 30-day resolution for other bureaus.

If you’ve experienced unwanted credit pulls, don’t panic. With the right process, you can restore your score and protect your financial standing.

Protecting Your Credit Before and After Renting

Knowing how landlord credit checks work gives you a real advantage.

You can ask better questions, apply strategically, and prevent score damage before it happens. And if your report already shows unnecessary hard inquiries, don’t let them hold you back.

Express Credit Boost can help remove hard inquiries quickly through its 24-hour Experian removal and multi-bureau credit repair services.

From unauthorized rental pulls to complex credit cleanups, our experts restore your score and peace of mind fast.

Contact us today to get started and take control of your credit future.