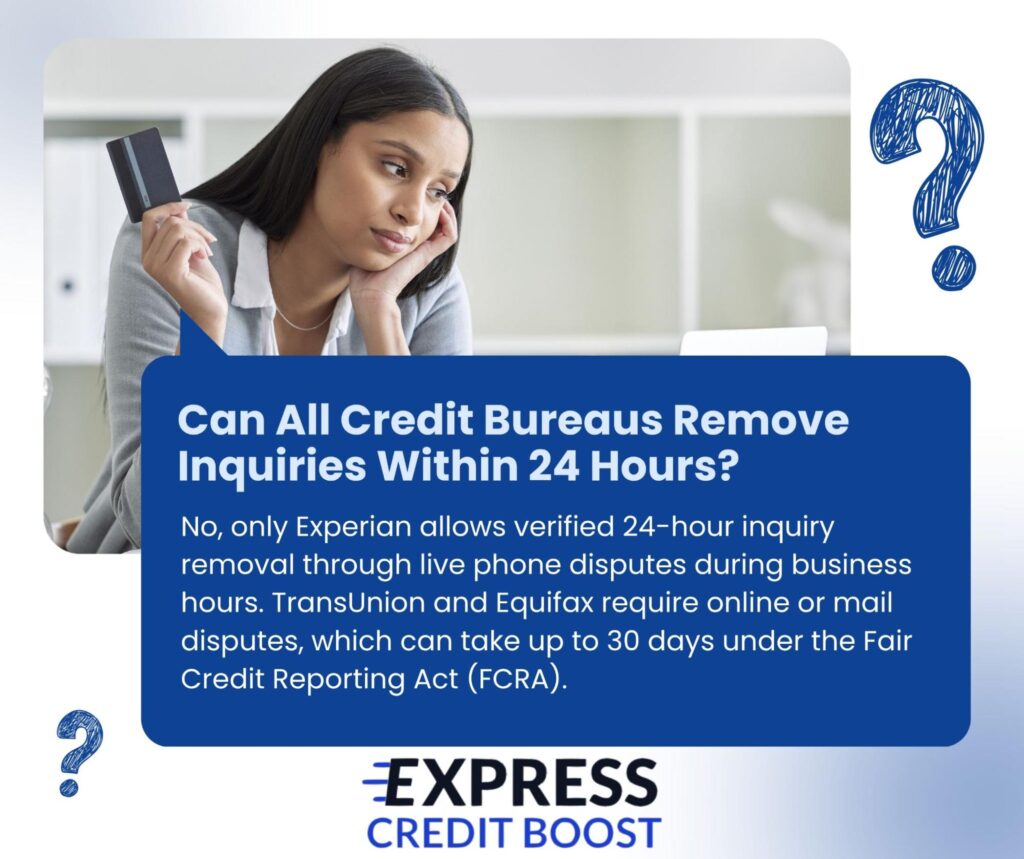

Only Experian allows verified 24-hour inquiry removal through same-day supervisor calls and proper documentation. TransUnion and Equifax require formal disputes that can take up to 30 days.

A quick inquiry cleanup can raise your score, improve loan approvals, and rebuild trust with lenders, if it’s done legally and correctly. Here’s what you need to know:

- Experian allows real 24-hour removals for unauthorized inquiries

- TransUnion and Equifax take longer, using 30-day mail or online investigations

- Only invalid or mistaken inquiries can be deleted under FCRA

- Legitimate credit checks must stay but lose scoring impact after one year

- Professional help can complete verified removals faster and more securely

When done properly, same-day Experian inquiry removal can open doors to better rates, approvals, and confidence in your financial standing.

Keep reading to learn how to maintain that momentum, avoid false promises, and protect your credit profile long after the inquiries are gone.

Where 24-Hour Inquiry Removal Is Real, And Where It Isn’t

When people hear “24-hour inquiry removal,” they often assume every credit bureau can make it happen overnight.

The truth is more nuanced.

Only one bureau, Experian, currently allows a verified, same-day inquiry dispute process, while the others follow a much slower route.

Understanding these differences is the key to setting realistic expectations and avoiding misleading claims.

Experian: The Only Bureau That Allows Same-Day Inquiry Removal

Experian stands apart because it permits live, phone-based disputes that can result in verified inquiry removals within 24 hours.

When a consumer or authorized representative provides proper identification, Experian can investigate certain inquiries immediately, especially those that are clearly unauthorized or inaccurate under the Fair Credit Reporting Act (FCRA).

It’s important to note that Experian operators do have some limits, not by the number of inquiries, but by the type. Some hard inquiries require written communication to both Experian and the lender to be fully resolved.

While Experian is not entirely paper-free, the overwhelming majority of disputes can still be handled over the phone.

This process works only during business hours. If you call on a Friday evening or weekend, the 24-hour window effectively begins on the next business day. Timing and proper documentation remain essential, since Experian carefully reviews each case before confirming any removal.

TransUnion and Equifax: Slower, Document-Based Processes

Unlike Experian, TransUnion and Equifax handle disputes exclusively through online or mail-based systems.

Once a claim is submitted, these bureaus have up to 30 days to investigate under FCRA guidelines.

Consumers can expect to wait several weeks before any changes reflect on their credit report. These processes comply with the law but are not designed for same-day outcomes.

Legal Boundaries and Common Misconceptions

No credit bureau or agency can legally guarantee the removal of legitimate inquiries within 24 hours.

The FCRA protects consumers’ right to dispute inaccuracies, but it also prohibits altering truthful information.

Any service claiming instant, across-the-board inquiry removal is likely misleading or in violation of federal law.

Knowing where 24-hour inquiry removal is actually possible helps you avoid frustration and false promises.

Experian’s same-day system is real but applies only to valid disputes. Next, we’ll cover which inquiries can be removed and which must stay on your report.

Helpful Resource → Hard Inquiry Removal Service Explained Clearly

Understanding Hard Inquiries and What Can Be Removed

Not every inquiry on your credit report is harmful, and not every one can be removed.

To protect your score and avoid mistakes, it helps to know the difference between the types of inquiries and what the law allows you to dispute.

Hard and Soft Inquiries

A hard inquiry happens when you apply for credit, such as a car loan or credit card. It can lower your score slightly for a short time.

A soft inquiry happens when you check your own credit or when a lender does a pre-approval check. Soft inquiries don’t affect your score at all.

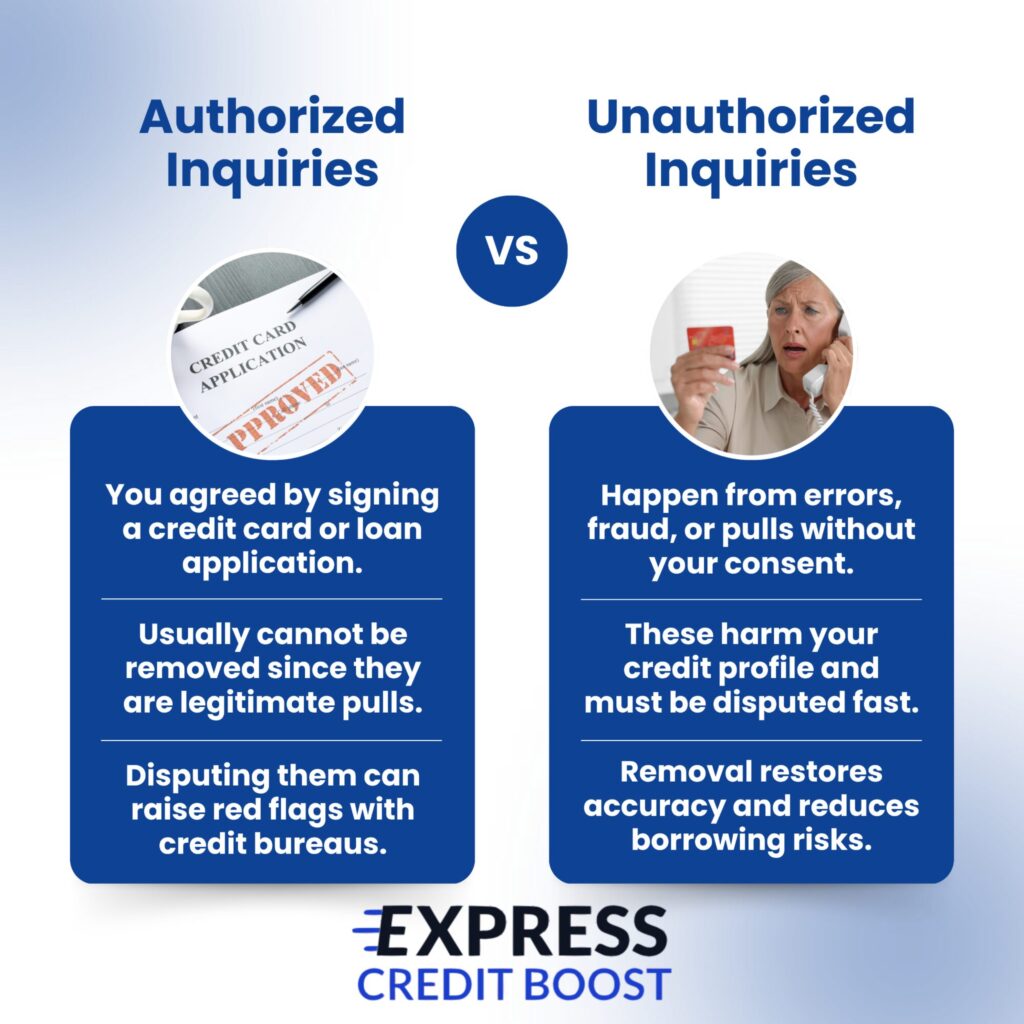

Which Inquiries Can Be Removed

Only unauthorized or inaccurate hard inquiries can be legally removed.

These include inquiries made without your consent or caused by reporting errors. To remove them, you’ll need to verify your identity and show documentation proving the inquiry was not authorized.

Which Inquiries Must Stay

If you applied for credit and gave permission for your credit to be checked, that inquiry must stay.

These legitimate checks remain on your report for up to two years, but they stop affecting your score after about one year.

Disputing them can make your file look suspicious to lenders.

Avoid “Too Good to Be True” Claims

Some companies falsely promise to delete all inquiries instantly by labeling them as fraudulent. That approach can break federal law and hurt your credibility.

Always stick with verified, lawful dispute methods that keep your report accurate and trustworthy.

Knowing which inquiries can be removed, and which can’t, helps you focus on what truly matters.

Next, we’ll look at why keeping your Experian report clean gives you a powerful advantage when applying for loans or credit.

Why Experian Matters Most for Fast Credit Recovery

When your goal is to boost credit fast, Experian deserves your full attention.

Among the three major bureaus, Experian’s data has the most influence on lenders, landlords, and business loan approvals.

Cleaning it up first often delivers the quickest results.

Experian and Business Lending

Experian is the primary bureau used for business and SBA loan checks.

Banks and lenders often look here first when assessing risk, which means too many recent inquiries can make you appear uncertain or overextended.

A clean Experian report can immediately improve your credibility with lenders.

Used by Dealers and Landlords

Car dealerships, mortgage companies, and property managers frequently rely on Experian reports before making decisions.

When your file shows multiple recent inquiries, it can suggest desperation for credit.

Reducing those inquiries helps you appear stable and reliable, which can quickly change outcomes.

Fast Results After Cleanup

Clients have seen noticeable changes within 24 to 48 hours of removing excess or duplicate inquiries from their Experian reports.

Even if your TransUnion and Equifax files still show older data, most lenders focus on the fresher Experian record when making approval calls.

Confidence from a Clean Report

When your Experian file looks clean, approvals start coming easier.

Your score rises, your credit stress drops, and financial opportunities reopen. A stronger Experian report isn’t just about numbers, it’s about restoring control over your financial story.

Starting with Experian gives you the fastest and most visible path to recovery.

Next, we’ll look at why professional help can make this 24-hour process simpler, safer, and more effective than trying to do it yourself.

Helpful Resource → How To Remove Hard Inquiries From Your Credit Report | Guide

Why Professional Help Makes 24-Hour Inquiry Removal Work

Fixing credit on your own is possible, but rarely fast.

The do-it-yourself route means writing long dispute letters, citing sections of the Fair Credit Reporting Act, paying for certified mail, and waiting weeks for a response.

Even with the best intentions, many people give up before seeing results.

The Reality of DIY Disputes

A DIY dispute often involves 10 to 20 pages of paperwork per bureau, along with supporting ID, proof of address, and correspondence tracking.

Each mailing can cost $30 to $40, and if documents are incomplete, the bureau may reject the dispute as “frivolous.”

While it’s legal, the process is slow, technical, and full of small details that can derail progress.

The Advantage of Professional Handling

Professional services such as Express Credit Boost use verified Experian channels for same-day supervisor calls and real-time verification.

This streamlined process replaces slow paperwork with fast, accurate handling that minimizes errors and delays.

Key advantages include:

- Verified Experian communication channels for faster inquiry confirmation

- Secure client portal for document uploads and identity verification

- Same-day contact with Experian supervisors for dispute validation

- Trained agents who prevent mistakes like disputing legitimate inquiries

- 24-hour turnaround for eligible Experian inquiries

In short, expert handling ensures your dispute is managed correctly, efficiently, and fully within the law, delivering results that DIY efforts rarely achieve.

Fast, Legal, and Risk-Free

With a pay-after-performance model, clients only pay once Experian confirms the deletion, eliminating upfront risk.

Professional support also ensures no legitimate inquiries are disputed improperly, protecting your credibility.

DIY works for those with patience and time, but professional help makes true 24-hour inquiry removal possible.

Next, we’ll look at how these rapid cleanups create real results and how just one day can change your credit story.

Also Read → When Do Hard Inquiries Fall Off? Guide and Timeline

The Real Impact of 24-Hour Inquiry Removal

When inquiries are removed quickly, the results speak for themselves.

Many people who were previously denied cars, apartments, or small business funding have seen approvals within days of cleaning up their Experian reports.

One day of proper dispute handling can reverse months of setbacks.

- Fast Approvals: Clients often move from rejection to approval within 24 to 48 hours once their Experian inquiries are cleared.

- Instant Score Boost: Verified removals can raise credit scores by 30 to 70 points almost overnight, unlocking better financing options.

- Improved Loan Terms: A stronger credit profile means lower interest rates and easier access to auto, mortgage, and business loans.

- Renewed Confidence: A clean report reduces stress and helps you approach lenders with confidence instead of hesitation.

- Better First Impressions: Lenders view a clear Experian file as a sign of financial stability, shifting you from high-risk to highly qualified.

- Lasting Relief: Beyond score improvement, a clean credit history restores peace of mind and financial momentum.

True results don’t happen by chance, they come from precision and legal process.

A clean Experian report can open doors that once felt closed, turning financial setbacks into new beginnings.

With the right process, even a single day can completely reshape your credit future.

Building Credit Confidence That Lasts

Real credit repair isn’t magic; it’s method, compliance, and precision.

By understanding how 24-hour Experian inquiry removal works and acting within the law, you can strengthen your credit faster and more safely.

A single day can redefine your financial story when it’s guided by expertise, not guesswork.

Ready to remove your Experian inquiries the right way?

Start your 24-hour removal process today with Express Credit Boost, the trusted leader in fast, compliant inquiry deletion and real credit recovery.