A hard inquiry removal service helps delete unauthorized or erroneous credit pulls that lower your score. It improves approval odds for loans, apartments, and credit cards by cleaning your report of unnecessary marks.

Hard Inquiry Removal: What You Can Fix and How It Helps

Hard inquiries are created when lenders check your credit during an application for a loan, credit card, or mortgage. Too many of them can weigh down your score and make you appear risky to lenders.

The good news is that not every inquiry has to stay. Here’s what you need to know right away:

- What can be removed: Unauthorized or fraudulent inquiries, as well as errors tied to misclassified pulls.

- What cannot be removed: Legitimate inquiries you consented to, such as loan or credit card applications.

- How removal helps: Each inquiry can lower your score by 5–10 points, and too many hard inquiries raise concerns for creditors, landlords, and even employers. Removing multiples can make a real difference.

- Process timeline: Experian removals can happen within 24 hours, while Equifax and TransUnion typically take 30 days.

Clearing unnecessary inquiries boosts your score, increases loan approval odds, and restores financial credibility, especially for business loan seekers who rely heavily on Experian reports.

This is only the surface.

By reading on, you’ll discover why inquiries show up in the first place, the advantages of removing them, and why professional help often delivers faster, safer results.

Understanding Hard Inquiries and How They Differ from Soft Checks

Before you explore removal services, it helps to understand the types of inquiries that appear on your credit report.

Many people mix them up, which can cause unnecessary disputes or confusion.

What Are Hard Inquiries?

Hard inquiries happen when you apply for new credit, such as a car loan, mortgage, or credit card. A lender reviews your history to decide whether to approve you.

Each inquiry can lower your score by about 5 to 10 points, though the impact is often closer to five.

Lenders also see these entries, which means several in a short span can look like risky borrowing behavior.

What Are Soft Inquiries?

Soft inquiries do not affect your score.

They include checking your own credit, receiving a pre-approval offer, or some employer background checks.

Soft pulls are visible only to you, never to lenders, so they carry no risk of denial.

What Is a FICO Score?

Your FICO score is the most widely used credit scoring model in the United States. It ranges from 300 to 850 and helps lenders assess how likely you are to repay borrowed money.

Payment history, amounts owed, length of credit history, new credit, and credit mix all contribute to this number.

Hard inquiries fall under “new credit,” which makes up about 10 percent of the total score.

How Long Do Inquiries Last?

Both hard and soft inquiries remain on your credit report for two years.

Only hard inquiries influence your FICO score, and even then, only during the first 12 months. After that, they no longer reduce your score, although lenders can still see the record.

Why This Distinction Matters

Many people mistake harmless entries for damaging ones.

Taking time to confirm whether an inquiry is hard or soft ensures you focus only on the items that truly affect your credit health.

Once you understand which inquiries matter, the next step is learning which ones can be removed and which are here to stay.

Inquiries You Can Remove and Those You Cannot

Once you know the difference between hard and soft inquiries, the next step is understanding which ones you can actually remove.

Not every entry on your report is eligible, and knowing the difference saves time and avoids unnecessary risk.

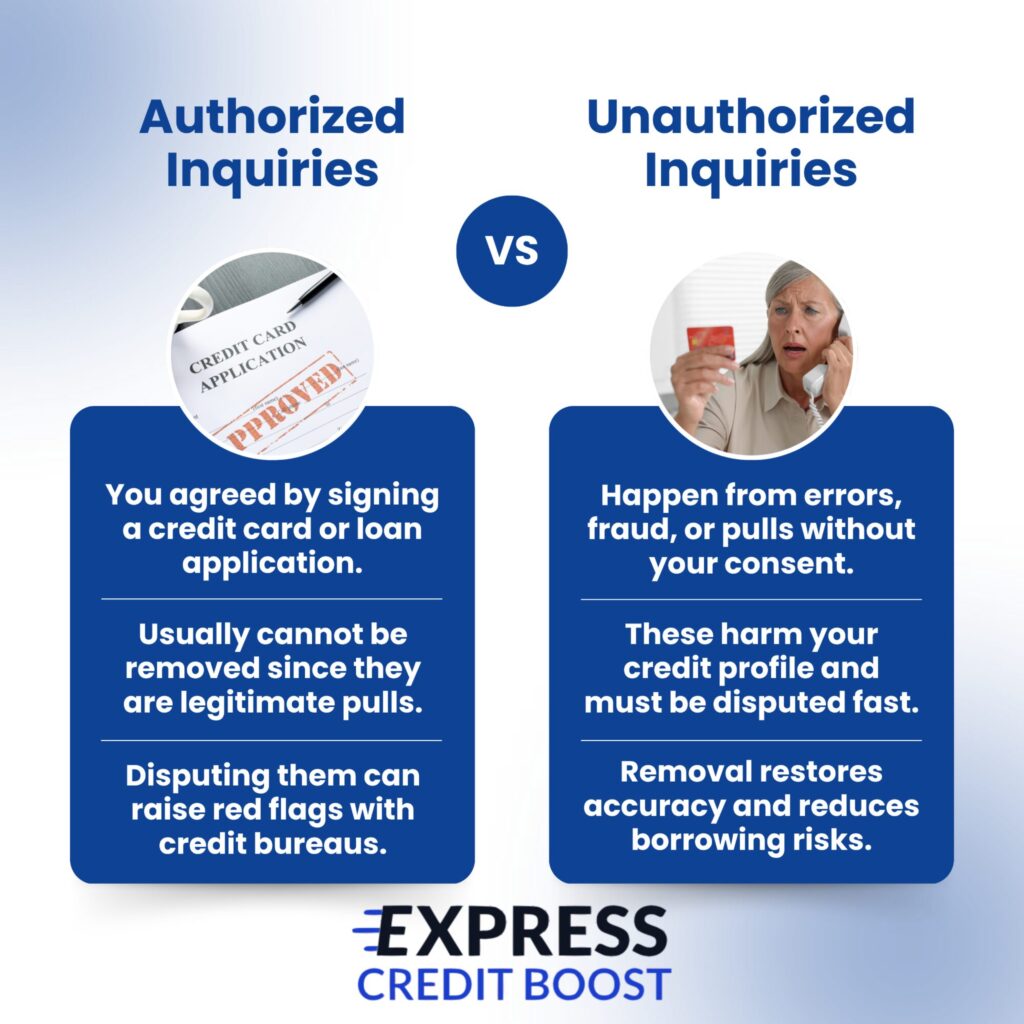

Authorized Inquiries

Authorized inquiries are those you agreed to, such as when you signed a credit card or loan application. These typically cannot be removed because they reflect legitimate credit activity.

Attempting to dispute them often raises red flags, and in some cases lenders have even penalized borrowers by limiting future access to credit.

Unauthorized Inquiries

Unauthorized inquiries include errors, identity theft, or situations where you never gave consent for your information to be pulled.

These should be disputed immediately to protect your credit profile and prevent further misuse.

How the Process Works Across Bureaus

The process for removal differs between credit bureaus.

Experian allows same-day dispute handling in certain cases, where inquiries can be resolved within 24 hours once documentation is in place.

Equifax and TransUnion generally require formal filings, which take around 30 days for review and resolution.

Timing matters, and delays in submitting documents can extend the process.

Clearing Up Common Misunderstandings

Many people go into the dispute process with the wrong expectations, which leads to frustration. A few key points help set the record straight:

- Fraudulent or unauthorized inquiries can be removed when properly contested.

- Legitimate, authorized inquiries generally stay on your report and disputing them can cause problems with lenders.

- No service can completely erase all inquiries from your history.

- DIY removal is possible, but it requires time, paperwork, and patience to see results.

Understanding these realities prevents wasted effort and helps you focus on the inquiries that truly matter.

Once you know which inquiries qualify for removal, it becomes easier to decide whether to challenge them yourself or seek support.

The next step is to look at why questionable inquiries appear in the first place.

Why Hard Inquiries Appear on Your Credit Report Without You Realizing

Many people are surprised when they review their credit report and see inquiries they do not remember approving.

These entries are not always the result of fraud, but they can still cause unnecessary damage if not addressed.

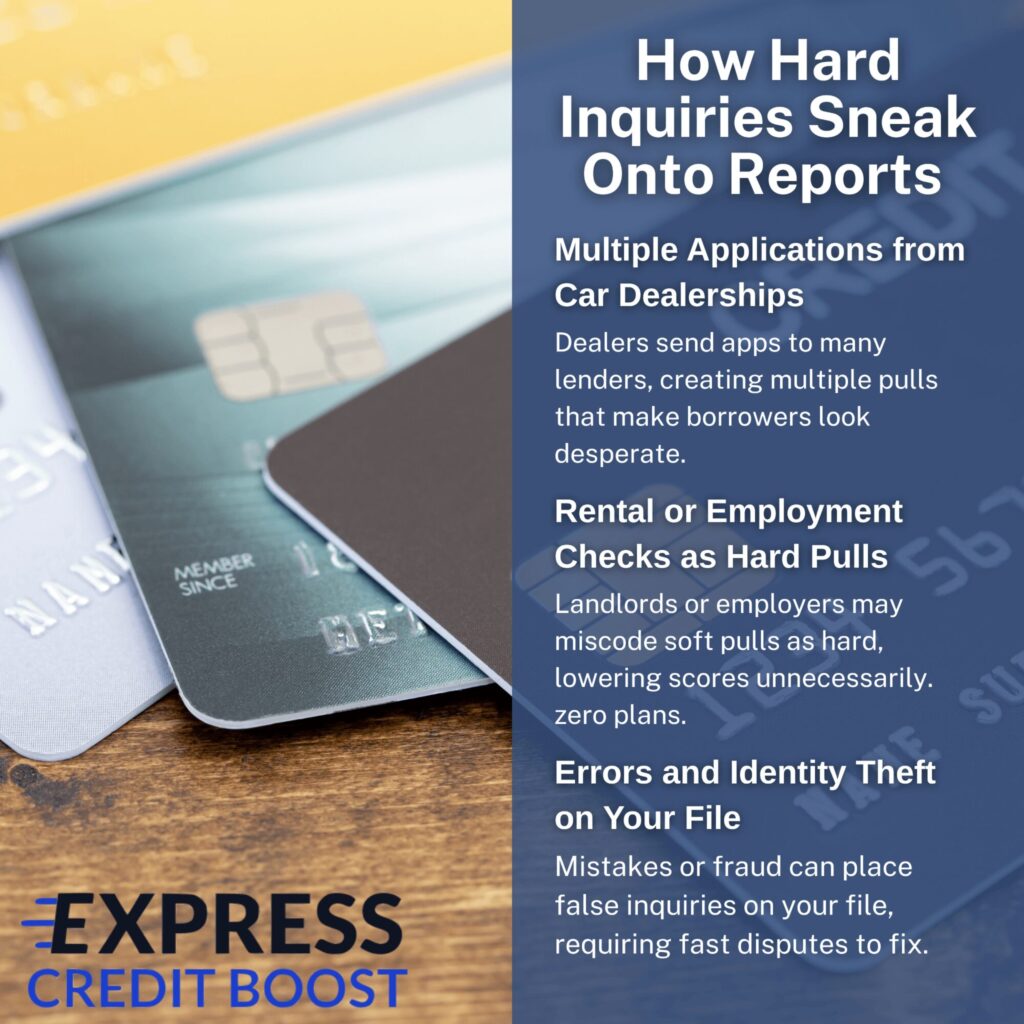

Multiple Applications from Car Dealerships

When shopping for a vehicle, dealerships often send your credit application to multiple lenders at once in hopes of securing approval.

While credit scoring models group these pulls together for scoring purposes, they still appear individually on your report, sometimes dozens in a single day.

This makes borrowers look desperate, even if the activity came entirely from one dealership visit.

Rental or Employment Checks Showing as Hard Pulls

Occasionally, landlords or employers run credit checks that should be coded as soft inquiries but are mistakenly listed as hard pulls.

This misclassification can lower your score unnecessarily and is one of the most common reasons people file disputes.

Errors and Identity Theft on Your File

Banks and credit bureaus process billions of transactions each month, and mistakes happen. At times, an inquiry may be incorrectly assigned to your file.

In more serious cases, someone may have used your personal information to apply for credit, leading to fraudulent inquiries that require immediate dispute and investigation.

Why Business Loan Applicants Are More Affected

For business owners, Experian reports often play a heavier role in loan approvals.

Excessive Experian inquiries can harm credibility with SBA or business lenders, even if personal credit is otherwise solid.

Understanding how questionable inquiries appear helps explain why removal is necessary. The next step is to see what advantages come from clearing these unnecessary marks off your report.

The Real Advantages of Getting Unnecessary Inquiries Removed

Removing hard inquiries may seem like a small step, but the benefits can be significant when they add up.

Clearing out unnecessary pulls improves not just your score but also the way lenders view your overall profile.

A Modest but Meaningful Score Boost

Each hard inquiry can lower your score by 5 to 10 points, which may not sound like much. However, when multiple inquiries accumulate, the effect can stack up quickly.

For someone with 10 or more inquiries, removal can mean a noticeable improvement in their score.

Better Chances for Loan and Rental Approvals

Lenders and landlords often use inquiries as a quick indicator of creditworthiness. Too many in a short period can suggest financial instability.

By removing unnecessary inquiries, borrowers increase their approval odds for mortgages, SBA loans, or even apartment leases where every point counts.

Improved Interest Rates and Terms

Fewer inquiries make you look less risky. This can translate into better interest rates and higher credit limits.

Even a small rate difference can save thousands of dollars over the life of a mortgage or business loan.

Relief from the “Desperate Borrower” Signal

A cluster of inquiries can give the impression that someone is struggling to secure financing. Removing those inquiries provides peace of mind and restores a cleaner, more credible credit profile.

A Case Example

One client faced more than 80 inquiries after a car dealer sent their application to dozens of lenders.

After having the inquiries removed, their credit profile improved enough to secure the financing they originally sought.

So, the advantages of removing inquiries go beyond a higher score, they strengthen your credibility with lenders.

The next consideration is whether to tackle the process on your own or rely on professional help.

Why Professional Help Often Outperforms the DIY Route

It is possible to dispute inquiries yourself, but the process often involves weeks of paperwork, slow responses from credit bureaus, and mounting costs.

For most borrowers, professional help proves to be faster, more efficient, and less risky.

Complexity of DIY Disputes

Effective disputes require detailed letters citing federal laws, sometimes stretching 10 to 20 pages.

Writing these without experience can be overwhelming, especially when multiple bureaus and creditors are involved.

The Hidden Costs of Doing It Yourself

Even if you invest the time, expenses mount.

Postage alone can reach $30 to $40 per round of disputes, and cases often require several rounds before resolution.

Add the value of your time, and DIY can quickly become more costly than expected.

The Waiting Game with Credit Bureaus

Equifax and TransUnion follow a 30-day review cycle for disputes.

This means you may wait weeks just to hear back, only to repeat the process if the bureau requests more information.

For those needing fast results, the timeline is frustrating.

Scale and Efficiency of Professional Teams

Professional services can handle dozens of inquiries in a single cycle, something most individuals cannot match.

A structured process makes bulk removals possible in a way that DIY efforts rarely achieve.

Avoiding Dangerous Missteps

One of the biggest risks for individuals is disputing the wrong items.

Claiming fraud on an authorized inquiry can trigger fraud alerts, account closures, or even bans from certain lenders.

Professionals know how to frame disputes correctly without crossing legal lines, ensuring progress without added risk.

For some, DIY is a learning experience. For others, the time, cost, and risk make professional help the smarter option.

Taking Control of Hard Inquiries

Hard inquiries may seem minor, but too many can drag down your credit profile and leave the wrong impression with lenders.

Understanding which inquiries matter, which can be removed, and how the process works is the key to protecting your financial credibility.

Whether you are trying to secure a mortgage, qualify for an SBA loan, or simply reduce the “desperate borrower” look on your report, addressing unnecessary inquiries is a practical and powerful step.

Express Credit Boost offers 24-hour Experian hard inquiry removal, full credit sweeps, and long-term repair services.

Once you upload the materials, we work to remove the hard inquiry from your Experian record over the next business day.

Contact us today to clean your credit report and improve your approval odds.